Varghese Pappachan is a consultative sales leader with over 20 years of experience in the IT Industry. Over the years, Varghese has built a strong expertise in Consultative Enterprise Software Sales in the Indian market. Varghese has worked as a Sales leader with large IT consulting firms like Wipro, Deloitte, Capgemini, Tech Mahindra, and Ramco Systems. Varghese is a trusted advisor to clients, he advises clients on their Enterprise, Analytics, and cloud journey by helping them define short and long-term digital transformation strategy.

Cloud Adoption – Moving to Cloud is not an option, it is a necessity!

Cloud has become the most disruptive technology in the market today it is the foundation for the digital transformation journey for many businesses. These days the debate in a typical CIO team’s discussion is not on whether to adopt cloud computing or not; the discussion now is more on how quickly workloads can be moved to Cloud. Today every CIO has a Cloud and Analytics agenda for 2020-21. The pandemic has only accelerated the Cloud adoption and different sectors based on their needs are moving workloads to the cloud.

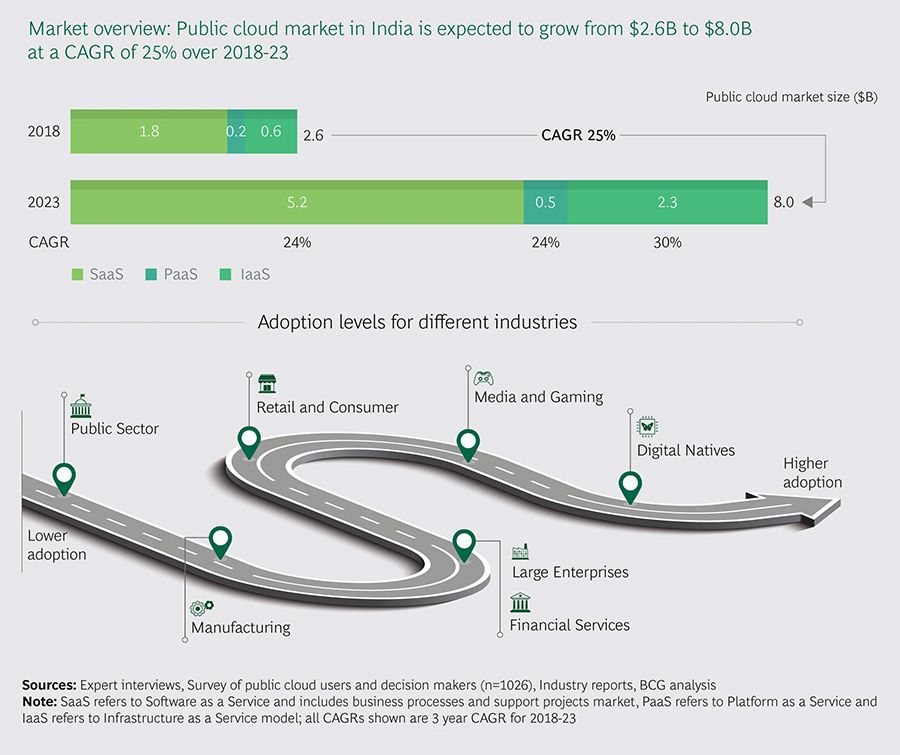

India’s public cloud market is among the largest in the Asia Pacific (APAC) region behind only Australia and Japan, according to a new analysis from Boston Consulting Group (BCG). By 2023, the consulting firm expects the public cloud market in India to reach the $8 billion mark.

Cloud Service providers (CSP) in the India market

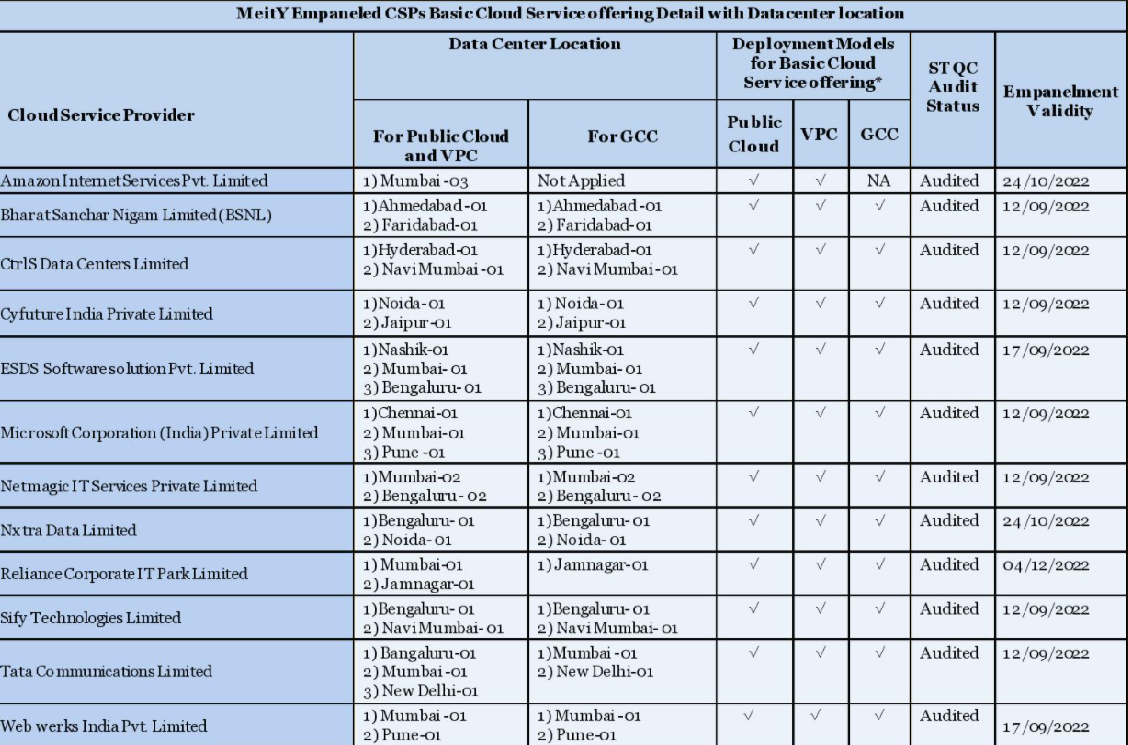

A cloud service provider is a third-party company offering a cloud-based platform, infrastructure, application, or storage services. While there are over 50 cloud service providers in the India market, I am sharing a list of 12 CSP’s impaneled at MeitY (Ministry of Electronics and Information Technology). The Cloud Deployment Models defined by MeitY are Public Cloud, Virtual Private Cloud (VPC), and Government Community Cloud. (GCC)

India has emerged as one of the leading grounds for cloud services. AWS has an early starter advantage and with an end to end cloud offering, it is leading the race in the Indian cloud market so far. It is also making fast inroads in the public sector and large enterprise accounts. AWS recently bagged a large cloud deal with CPWD (Central Public works departments). Few AWS cloud customers in the enterprise segment are HDFC Life, Ashok Leyland, Aditya Birla Finance, etc.

Microsoft with full fledge Azure platform is another big player in the Indian cloud market, it benefits from its long-standing relationship with all state governments & existing agreements with most of the large enterprise clients in India markets. The most significant cloud partnership for Microsoft in India recently was with Reliance Jio. Recently the two entities entered into a 10-year strategic partnership, where Jio would set up data centers across India, with Microsoft deploying its Azure platform to support Jio’s offerings.

Other large global players like Google, Oracle, IBM are also getting very aggressive in the Indian cloud market. Google Cloud is now seen competing in most of the large enterprise deals, recently Google bagged a large cloud deal with TVS automobile; Oracle Cloud too bagged a large deal with Niti Aayog to modernize IT infrastructure underpinning the aspirational district’s program; IBM has a strong presence in some of the large enterprise accounts, IBM had earlier bagged a 5-year Cloud & AI deal from Vodafone.

The Indian cloud service providers like ESDS, CTRL-S, Tata Communications, NetMagic, and Sify have been early entrants in the private cloud space providing IAAS. All these players are also gearing up their infrastructure, OEM partnerships & service portfolio to grab a share of this big public cloud market.

Cloud adoption in various sectors

The Big Data revolution in recent years has forced enterprises to improve their capacity to access and make meaningly analysis of both structured and unstructured data coming from various sources. Instead of making additional Capex, enterprises are now looking at cloud infrastructure as a superior option to boost the capacity to handle data and provide an unrivaled level of agility, security, and scalability.

We are all witnessing today a huge surge in demand for cloud & digital transformation technologies and public cloud is leading the forefront of all infra-related investments. According to a recent IDC’ survey, as a result of the spread of the pandemic, 64% of the organizations in India are expected to increase demand for cloud computing while 56% for cloud software support the new normal. The need to work remotely is also bolstering the demand for SaaS-based collaborative apps to ensure zero-disruption to business. Industries like media, education, and IT/ITeS are seeing an increased uptick primarily because of online entertainment, virtual classrooms, and increased need for collaboration as a result of increased remote working.

As industries move away from Capex to Opex models for Infrastructure ownership, cloud pay-per-use models are likely to see an accelerated demand. Also, I believe as a derisking mechanism; most companies will move with the hybrid approach initially before moving all their workloads to the public cloud over the coming years.

Government & Public Sector in Cloud –. To harness the benefits of the cloud, the Department of Electronics and IT (DeitY) of the Government of India has embarked upon an ambitious project termed as ‘GI Cloud’. The ‘GI Cloud’ is the Government of India’s cloud computing environment that will be used by government departments and agencies at the center and states. In other words, it will enable the government to leverage cloud computing for effective delivery of e-services We can see the intent & lot of traction from the states and central government to embrace cloud computing technology for expanding their e-governance initiatives throughout the country.

Manufacturing in Cloud – Indian Manufacturing have been early adopters of cloud applications. Indian manufacturing companies are adopting cloud models to implement CRM, ERP, enterprise mobility tools, and dashboards to share information and enhance accuracy in their production process. ERP continues to be the primary enterprise IT application for manufacturing companies. Other areas would be around Supply Chain, Warehousing, IoT, etc

Banking in Cloud – Despite regulatory and security concerns, banks are slowly beginning to move towards cloud computing. Core banking is one of the toughest workloads to migrate onto the cloud. However, within core banking, there can be specific workloads that can be migrated which are mostly around the customer servicing area, such as Cash Management, Know Your Customer (KYC) validation, Credit rating business process, etc.CRM software is an obvious choice for cloud computing and most banks have already deployed CRM on the cloud

Small & Medium Business (SMB) in Cloud – Sharing some insights into a study done by Microsoft India & TARI (Thought Arbitrage Research Institute) with 278 small & medium businesses in 11 cities. The study noted that SMBs can have improved cash flows of up to 308 percent due to the “dexterity and flexibility” enabled by cloud usage. 96 percent of SMBs found a positive impact on their operating expenses within two years of cloud use. Security, business continuity, and risk management emerged as other key areas as 86 percent of SMBs believed that the cloud was a secure platform and that they experienced less risk of loss of confidential information. In Summary, Cloud technology is emerging to be the new SMB backbone for success in the new normal.

Conclusion

I firmly believe the next decade belongs to Artificial Intelligence and Cloud Computing. While there could be some datacentre consolidation in the future, but for now that cloud market in India is a huge business opportunity and up for grabs for both Indian and global CSPs. The cloud market will have a huge positive impact on the Indian economy, BCG predicts by 2023 the public cloud market in India could have contributed as much as $102 billion direct and indirect value to the Indian economy & create employment, at approximately 980,000 jobs over the same period.