Nouamane Cherkaoui started his career in Capital Venture and e-Payment Systems. He created his Start-up in 2001. Nouamane is an experienced Chief Information, Transformation & Data Officer with a demonstrated history of working in international financial services. He led strategic IT transformation and innovation projects at Caisse d’Epargne, Natixis, Postal Bank & Société Générale. He joined BPCE Group in 2021 to lead The Transformation Office at BPCE-SI. Nouamane is an author and member of Data & IA Think Tank. Also, he has given talks and presentations on various Digital Transformation matters (Data, API, AI & open banking) and collaboration with Tech start-ups).

We are not so far from the fintech hype of recent years which predicted a dramatic and close end to traditional financial institutions all over the world. FinTech’s were expected to reshape the banking sector as people becoming used to be accustomed to new convenience and a certain freeness service, without any compensation. The FinTech industry has been growing rapidly and significantly, becoming the go-to service provider for some of the most important financial services, such crowdfunding platforms, online portfolio management tools, including mobile payment solutions, lending, and payments. They were enabling customers to get the same services as traditional institutions, but enhanced with personalized advice, personalized recommendations, gamification, and other new ideas and tailored services, … the great promise of neo banks.

The question was not how Fintech’s will replace traditional financial industries, but when? This article is intended to set the record straight.

I acknowledge that I was part of this thought, that incumbent banks and insurers were catching up, for some, with a technological gap which had been widening since the advent of Fintech’s, while news startups offered their new and young clients the hight level innovation they expect.

Indeed, if the shock wave of the Covid crisis spared neither banks nor FinTech’s, it caused damage for many FinTech’s and impacted the young collaboration between start-ups and large groups.

The first confinement had a negative impact for many start-ups with a deterioration in their commercial development and fundraising. Only resisted startup with solid financial foundations or adapted their model to the crisis. Nevertheless, the onset of COVID-19 has substantially impacted this neo-industry, both positively and negatively.

The financial sector also suffered from this crisis with a decline in economic activity, but accelerated the digital transition, demonstrated the resilience of the sector in the face of this pandemic and strengthened customer confidence in their banks. Banks’ support for customers and businesses directly or through government aid, continued despite the gradual lifting of government support measures for the economies.

Even if in this post-crisis context, large financial groups have had less time and money to exploratory searches to refocus on the issues of their own digital transformation and improvement of services to their clients, the global level financing of FinTech’s has not decreased and has even offered record deals.

The United States still concentrate more than half of fundraising. However, venture capital funding for fintech startups globally plunged 49% year-over-year to $23 billion in the first half of 2023 amid an economic slowdown. This decline in overall financing value began during the second half of 2022, although there is renewed interest in technology financing values[1]. Investments in USA are generally concentrated around solutions that simplify the experience, like as investing in the stock market (Robinhood Stock trading app valued at more than $8 billion today), or Robotic process automation (RPA) platform raises $750M at $35B valuation for example. Europe comes in second place with almost a quarter of FinTech’s fundraising (22%), including Klarna ($650 million), the new Swedish unicorn allowing deferred payment without fees, Ki ($500 million) born from the collaboration between the English insurer Brit and the technology giant Google to redefine the experience of business premises insurance, as well as TransferWise ($319 million)[2]. In France Qonto, which opens professional accounts, raised 552 million euros at the start of 2022 and still maintains its independence[3].

Usually, cultural differences can make these collaborations complicated[4], especially after the post-crisis context, which led to the refocusing of collaborations on fundamental needs and niche strategy. Several Fintech’s now follow this niche market orientation and clearly state the strategy of collaboration or competition between these FinTech and BFSI.

What Has Changed in The Relationship Between Financial Institutions and Fintech’s?

The relationship between financial institutions and Fintech companies has evolved significantly in recent years. Although the details may have changed since my last articles, I explain below a general overview of the main changes that had taken place until then, and which are likely to continue or evolve further:

- Collaboration and Partnerships: Financial institutions have increasingly recognized the potential of fintech companies to enhance their services and improve operational efficiency. This has led to more collaboration and partnerships between traditional banks, insurance companies, and fintech firms. These partnerships involve investment, joint ventures, or strategic alliances to leverage each other’s strengths. If at the beginning there was mutual distrust, the purchase of FinTech’s by BFSIs was not always a success.

- Regulatory Changes: Regulatory bodies in various countries have been adapting to the growing influence of fintech. New regulations, such as PSD2 in Europe and open banking initiatives in several regions, have been introduced to foster innovation while ensuring consumer protection and data security. Fintech companies are also subject to increase security to comply with these regulations.

- Data Sharing and APIs: Open banking initiatives have encouraged financial institutions to share customer data securely with fintech companies through application programming interfaces (APIs). This enable fintech firms to create innovative financial products and services, such as budgeting apps and personal finance management tools.

- Customer Experience: Fintech companies have raised the bar for customer experience by offering user-friendly interfaces, 24/7 accessibility, and personalized services. Traditional financial institutions are investing in technology and customer-centric approaches to compete in this aspect.

- Innovation 3 mains financial services:

- Payment Services: Fintech has disrupted the payments industry significantly. Mobile payment solutions, digital wallets, and cryptocurrencies have gained in popularity, and traditional financial institutions have been adapted by integrating these technologies into their offerings.

- Wealth Management and Robo-Advisors: Fintech companies have introduced automated investment platforms, known as robo-advisors, which have gained traction among investors. Traditional wealth management firms have responded by developing their own robo-advisor offerings or partnering with fintech companies to provide these services.

- Lending and Credit: Fintech has revolutionized the lending industry by introducing peer-to-peer (P2P) lending platforms, alternative credit scoring models, and faster loan approval processes. Traditional banks have explored collaborations with fintech firms to streamline lending operations and enhance risk assessment.

Fintech’s and startups continue to disrupt the financial industry, challenging traditional players to adapt quickly or face obsolescence. This competitive landscape has led to a greater focus on innovation and customer satisfaction across the sector.

Why Have FinTech’s Failed to Compete with Incumbent Banks and Insurers?

FinTech’s have not necessarily “failed” to compete with traditional banks and insurers, but they have faced several challenges and barriers that have made it difficult for them to completely disrupt the financial services industry. Here are some key reasons why FinTech’s have faced challenges in competing with traditional banks and insurers[5]:

- Regulatory Hurdles: The financial industry is heavily regulated, and fintech startups often face significant regulatory hurdles when trying to enter the market. Complying with complex regulations can be costly and time-consuming, which can hinder the ability of FinTech’s to scale quickly. The simplification of certain regulations has often been contested by certain banks for unfair competition.

- Capital Requirements: Banks and insurers generally have access to substantial capital, which allows them to invest in technology, infrastructure, and customer acquisition. Fintech startups may struggle to compete with traditional institutions in terms of financial resources. Some Startups have been bought by large companies, which has limited their agility and innovation.

- Trust and Reputation: Traditional banks and insurers have established trust and a strong reputation over many years. Consumers often feel more secure dealing with established financial institutions, especially when it comes to sensitive financial matters. Building trust can be a significant challenge for fintech startups. The strength of the banks during the crisis reinforced this point.

- Customer Acquisition Costs: We know that customer acquisition in the industry is central et can be more expensive. Traditional banks and insurers often have existing customer bases and established distribution channels. FinTech’s may need to spend a significant amount on marketing and customer acquisition to compete over time.

- Network Effects: As the sector has never been open to competition, traditional banks and insurers benefit from network effects, where the value of their services increases as more people use them. FinTech’s may struggle to achieve the same network effects, especially in areas like payments and lending.

- Risk Management: Regarding the regulated sector, banks and insurers have sophisticated risk management systems in place to assess and manage financial risks. FinTech’s may have limited experience in dealing with complex financial risks, which can be a barrier to competing in certain segments of the market.

- Legacy Systems: Traditional financial institutions often have legacy IT systems that can be difficult to modernize. However, these systems are deeply integrated into the operations of these institutions, making it challenging for FinTech’s to replace them entirely.

- Competition and Collaboration: In some cases, FinTech’s have chosen to collaborate with traditional banks and insurers rather than compete directly. This partnership approach can be a successful strategy for FinTech’s, but it may not lead to complete disruption.

Established banks and insurers have well-known brand names that can be challenging for FinTech’s to compete against, particularly when it comes to attracting customers.

The financial services industry is highly fragmented, with many different niches and segments. FinTech’s may excel in specific niches but face challenges when trying to compete across the entire industry.

Fintech’s And Financial Institutions, From Competition to Collaboration

The relationship between fintech (financial technology) companies and traditional financial institutions has evolved over the years from competition to collaboration. Here’s a brief overview of this transformation:

1. Competition (Early Stage – Disruptive effect):

Disruption: In the early stages of Fintech’s, many startups aimed to disrupt traditional financial institutions. They introduced innovative technologies and business models that challenged the status quo.

Challenges to Incumbents: Fintech companies often targeted specific niches of the financial services industry, such as payments, lending, or wealth management, and competed directly with banks and other established institutions.

Customer-Centric Approach: FinTech’s focused on providing a better user experience, often leveraging technology to offer more convenience, lower fees, and faster services.

2. Transition (Middle Stage – Opportunistic strategy):

Regulatory Environment: With the development of Fintech’s, regulators recognize the need to adapt regulations to accommodate these new players while ensuring consumer protection and financial stability.

Partnerships: Often opportunistic, some FinTech’s began partnering with traditional financial institutions to gain access to their customer bases and infrastructure. Banks, in turn, saw these partnerships as opportunities to enhance their digital offerings.

Acquisitions: In some cases, established financial institutions acquired Fintech’s and startups to integrate their technology and expertise into their existing operations. They choose products or services in which they are behind the market.

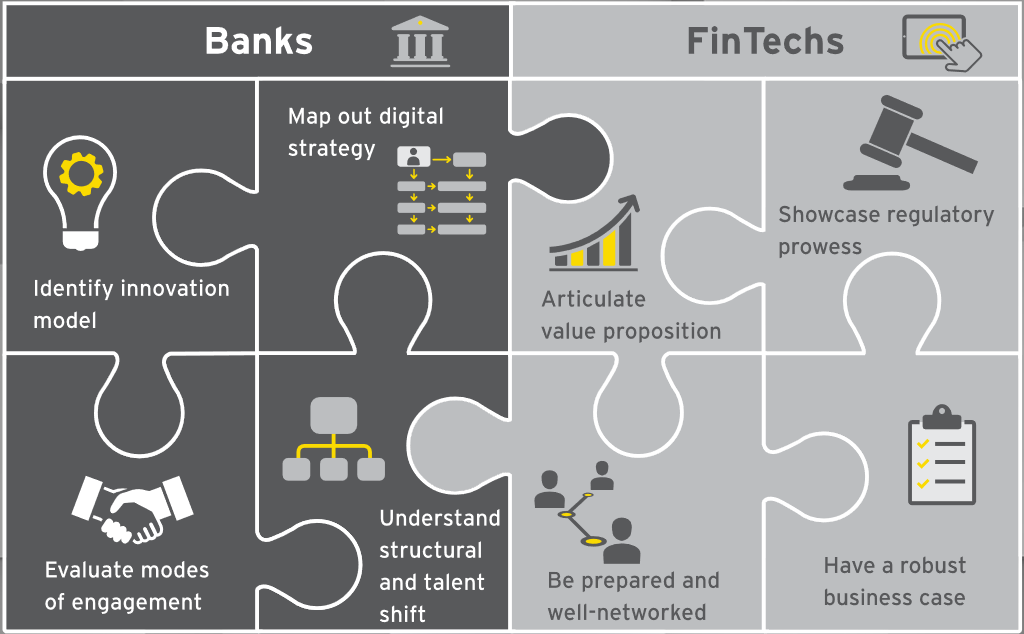

3. Collaboration (Current Stage – Coopetition strategies):

Open Banking: In the early days of Open Banking, it was regulatory initiatives such as regulatory initiatives like PSD2 in Europe and similar efforts elsewhere have encouraged collaboration by requiring banks to provide access to customer data to authorized third-party providers. This has led to the development of APIs and open banking platforms.

Fintech Ecosystems: Taking advantage of past mistakes, many financial institutions have established fintech incubators, accelerators, or innovation labs to foster collaboration with startups. These initiatives often include mentoring, investment, and co-development opportunities.

Hybrid Models: Originally, many Fintech’s had the ambition to become licensed financial institutions, thus blurring the lines between traditional finance and digital finance. The step being too high, the path of becoming a provider was quickly taken to push this collaboration with the banks, others continue to believe in it in niches.

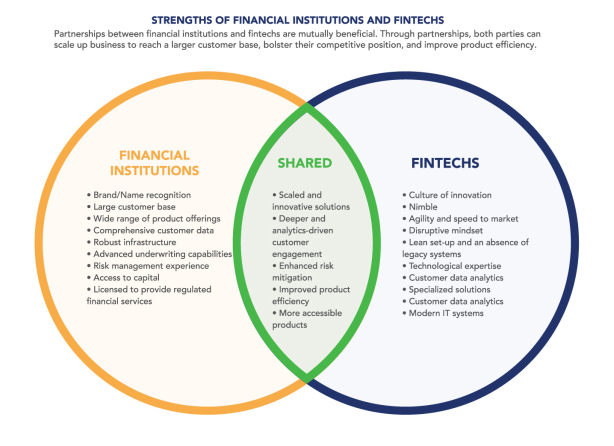

4. Benefits of Collaboration:

Synergy: Collaboration allows FinTech’s to leverage the scale, trust, and resources of established financial institutions, while banks benefit from the agility and innovation of fintech partners.

Expanded Services: Customers have access to a wider range of financial services and innovative products by taking the “Best Of” in each category.

Regulatory Compliance: Collaboration helps FinTech’s navigate complex regulatory landscapes with the support of established institutions.

Risk Mitigation: Traditional financial institutions can diversify their risks by partnering with FinTech’s in areas where they may lack expertise.

5. Challenges and Risks:

Cultural Differences: FinTech’s often have a more agile and business culture, which can clash with the risk-averse and highly regulated culture of traditional banks.

Data Security: Collaborative efforts must address data privacy and security concerns, especially when sharing customer information.

Competitive Pressures: Collaboration does not eliminate competition entirely, as FinTech’s and banks may still compete in some areas and segments.

In conclusion, the fintech landscape has evolved from fierce competition to a more collaborative approach, driven by regulatory changes, customer demand for innovative solutions, and the recognition that each side makes its contribution. This collaboration is likely to continue evolve as technology advances and the financial industry adapts to new opportunities and challenges.

Fintech has played an important role in accelerating investments related to the digital transformation of financial institutions. Traditional banks have invested heavily in upgrading their technology infrastructure to compete with startups and FinTech’s. These investments have enabled improving customer experience, speeding up transaction processing times and increasing security.

Huge expectations are currently surrounding AI, and it could be the next breakthrough in the supporting digital transformations. AI becoming a privileged way to innovate both by financial services and FinTech’s enabling them to deal with the new challenges that they are facing and encourage collaboration over than competition.

This AI field is becoming an opportunity to jump onto the AI bandwagon to take advantage of this technological trend which enables to achieve competitive advantages through automation, cost optimization, insight-driven decisions, and customer experience enhancement.