Roland Staehli is the visionary Founder and CEO of WebAccountPlus (Holding) AG, a Switzerland-based company that has revolutionized the corporate advisory landscape through cutting-edge digitalization. With over four decades of experience in banking, entrepreneurship, and computer economics, Roland has become a prominent figure in the financial technology sector. His journey spans multiple continents, including Africa and Asia, and countries, including Austria and Germany, with a private footprint in Malaysia. This global exposure has provided Roland with a unique perspective on the diverse needs and challenges faced by businesses of all sizes.

Roland’s relentless drive to bridge the digitalization gap in the corporate sector led to the inception of WebAccountPlus. Fueled by his passion for creating meaningful and sustainable solutions, he embarked on a five-year journey of extensive research and collaboration. This dedicated effort resulted in the founding of WebAccountPlus (Holding) AG in November 2021. In a recent insightful conversation with Digital First Magazine, Roland Staehli delved into the core mission of WebAccountPlus, unveils its unique selling points (USPs), and offers a glimpse into the company’s ambitious long-term vision. Let’s explore the highlights of this engaging conversation.

Can you provide a brief overview of WebAccountPlus, its mission, and the services it offers to clients worldwide?

WebAccountPlus is a pioneering digital corporate advisory platform and ecosystem designed to serve businesses, particularly SMEs, worldwide. Our mission is to empower companies by providing them with comprehensive digital support, allowing them to emancipate themselves from third parties and make informed decisions about their financial and business management.

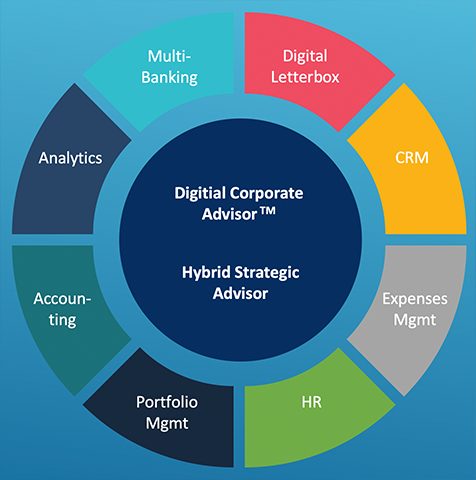

We offer a wide range of services that cover all aspects of corporate operations. These services include full-house accounting services, CRM, AI based spend management, multi-banking, cash management, asset management, analytics, HR management, strategy tools, ESG rating, company valuation, and industry comparisons. Our flagship offering, the Digital Corporate Advisor ™ (DCA), provides real-time data analytics and business management guidance.

How did the idea for WebAccountPlus come about, and what inspired its creation?

The idea for WebAccountPlus stemmed from the need to address the digitalization gap in the corporate world. While digitalization was making waves in the consumer banking sector, businesses were still grappling with inefficient, manual processes, often reliant on expensive consultants. Our inspiration came from the desire to create something substantial and sustainable, benefiting all participants in the corporate world, from SMEs to accounting companies to bank advisors and insurance providers.

Through extensive research, discussions, interviews, and a deep understanding of business needs, we shaped our vision for a comprehensive digital solution that automates every aspect of corporate operations. Our goal was to create a “Win-Win” situation for all stakeholders, and we set out to build the world’s first Corporate Ecosystem.

Could you highlight the key features and innovations that set WebAccountPlus apart from other accounting service providers?

WebAccountPlus stands out for several reasons. First, we offer an all-in-one solution that covers not only accounting but also the entire spectrum of corporate needs, from CRM to asset management. Our Digital Corporate Advisor ™ (DCA) uses real-time data to provide actionable insights and leads the way in proactive business management.

Our open API financial platform Open Corporate ™ allows seamless integration with partners and offers unparalleled flexibility. We also emphasize security and reliability, keeping client data in the Swiss cloud, known for its stringent data protection laws.

Can you explain how the Open API financial platform works and its significance for clients?

Our Open API Finance Platform Open Corporate™ offers a connected SME, in case of a possible financing, investment, job filling, consulting or product need, etc., thanks to our Digital Corporate Advisor™, the automated possibility to provide its quote requests anonymously to other Eco-systems and market participants from the corporate world. These can be banks, corporate advisors, insurance companies, job portals, suppliers, factoring companies, leasing companies, etc.

These, in turn, also make their offer available, anonymized or not, in our open platform. The customer accepts or rejects. In case of acceptance, the names are activated on both sides, and the transaction can be processed electronically immediately. This is our flexible, integrated ecosystem of the future.

Could you discuss the partnerships WebAccountPlus has with software providers and how they contribute to the platform’s success?

Our partnerships with software providers are essential to expanding the services available to our clients. By collaborating with software providers, we can offer a wider array of tools and solutions that integrate seamlessly with our platform. These partnerships enhance the overall value we provide to our clients and ensure they have access to cutting-edge technology.

How does WebAccountPlus approach software development and integration within its open architecture framework?

We approach software development with a focus on state-of-the-art tools and practices. Our development process ensures full traceability, from envisioning and requirements gathering to architecture, coding, and testing. Within our open architecture framework, we prioritize integration capabilities, making it easy for third-party providers to connect their solutions with our platform, fostering a dynamic and comprehensive ecosystem.

What strategies does WebAccountPlus employ to establish itself as a market leader both nationally and internationally?

To establish ourselves as a market leader, we leverage our extensive network of industry experts and partners. We focus on forming strategic alliances and entering into joint ventures with financial institutions, accounting companies, and other key players in various countries. This approach allows us to expand rapidly and offer our solutions on a global scale.

Can you provide more details about the Digital Corporate Advisor TM (DCA) and how it benefits clients and professional advisors? How does the DCA leverage real-time data for decision-making and lead generation?

The Digital Corporate Advisor ™ (DCA) is a transformative tool that continuously monitors a company’s performance by analyzing real-time data. It provides proactive guidance and identifies opportunities or challenges. For clients, it means staying ahead of financial issues and making informed decisions. For professional advisors, it offers a powerful tool for providing value-added services to clients and identifying new business opportunities.

Could you elaborate on how WebAccountPlus utilizes artificial intelligence and automation to reduce administrative efforts for clients?

We utilize artificial intelligence (AI) and automation to streamline and simplify administrative tasks for our clients. AI algorithms handle repetitive, time-consuming tasks such as data entry and verification. Automation ensures that processes like accounting and expense management are efficient and error-free, saving clients both time and resources.

You emphasize the importance of security and reliability. Could you explain how WebAccountPlus ensures these aspects for its clients, especially regarding data stored in the Swiss cloud?

Security and reliability are paramount in our services. Storing data in the Swiss cloud ensures compliance with strict Swiss data protection laws, offering clients peace of mind. We also employ robust encryption protocols and maintain redundant data centers to safeguard data integrity and availability. Regular security audits and updates further bolster our commitment to maintaining a secure and reliable environment.

What challenges has WebAccountPlus faced during its journey, and what lessons have been learned along the way? How does the company adapt to evolving technologies and market demands?

Our journey has seen its share of challenges, including navigating complex regulatory landscapes and fostering international growth. Through these challenges, we’ve learned the importance of adaptability and the need to stay ahead of evolving technologies and market demands. We embrace change, invest in research and development, and maintain a proactive stance to ensure our solutions remain at the forefront of innovation.

What is WebAccountPlus’s long-term mission in terms of technology and innovation leadership?

Our long-term mission is to continue leading the way in technology and innovation, setting new standards for corporate digitalization. We aspire to shape the future of corporate advisory by constantly enhancing our ecosystem, expanding our partnerships, and pioneering groundbreaking solutions that empower businesses worldwide.

How does the company plan to sustain profitable growth and maintain Swiss quality standards in the future?

To sustain profitable growth and maintain Swiss quality standards, we are actively seeking collaborations with governments globally to facilitate the digitization of physical letters, further enhancing our services. We are also exploring opportunities for integration with existing platforms and the expansion of tools related to financing, investment, and HR. Through these strategic initiatives, we aim to continually evolve while upholding our commitment to Swiss quality and excellence.

For More Info: https://www.webaccountplus.com/

More About Roland Staehli, Founder and CEO of WebAccountPlus (Holding) AG

Under Roland’s leadership, WebAccountPlus has introduced a pioneering corporate advisory platform and ecosystem, delivering comprehensive digital support to SMEs and other enterprises worldwide. His commitment to building an all-encompassing solution, including the groundbreaking Digital Corporate Advisor TM (DCA), reflects his dedication to empowering businesses to make informed decisions and embrace the digital era fully.

With Roland Staehli at the helm, WebAccountPlus continues to shape the future of corporate digitalization, setting new standards for technology and innovation leadership while upholding Swiss quality and excellence. His expertise, combined with his unwavering passion for digital transformation, drives the company’s mission to create a “Win-Win” situation for all stakeholders in the corporate world.

As a thought leader and visionary in the financial technology sector, Roland Staehli remains committed to empowering businesses to thrive in the digital age. His relentless pursuit of innovation and sustainability ensures that WebAccountPlus remains at the forefront of the industry’s evolution.